- Home

- Domestic Taxes

- File a Return

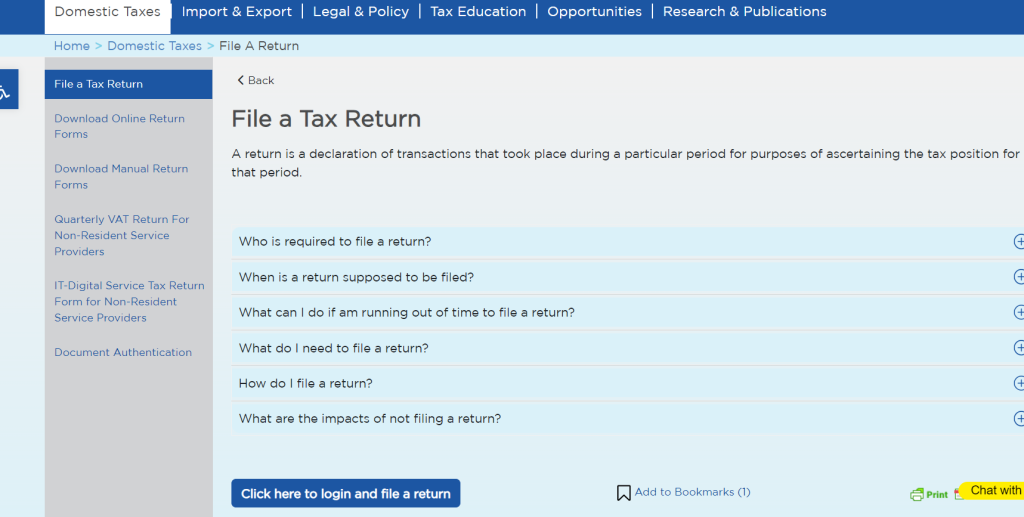

File a Tax Return

A return is a declaration of transactions that took place during a particular period for purposes of ascertaining the tax position for that period.

All persons with income exceeding 2,820,000 a year, save for employees who earn income from only employment and with one employer.

- Annual returns i.e. Income Tax, within six (6) months from the end of the financial period e.g. taxpayers with 30th June as the accounting date, the deadline to file returns is 31st December every year.

- Monthly Returns i.e. VAT, WHT, PAYE, LED.

This is the 15th day of the month following the return period - Weekly Return i.e. Gaming and Lotteries returns, by Wednesday of every week.

You can apply for an extension to seek permission to file a return late however the extension cannot exceed an aggregate of 90 days. This extension shall not change the due date of payment of tax due for that period.

All the information required to file that particular return. E.g. for VAT, you need all purchase and Expenses and Sales (Including all taxable and exempt sales) transactions. Including those transactions where VAT has not been charged or incurred.

NB: Currently all transactions for input and output tax should be bearing FDNs from EFRIS.

Follow the steps below;

Step 1: Visit the URA web portal https://ura.go.ug and on the home page, click File a Return.

Step 2: On the file a tax return page, click here to login and file a return.

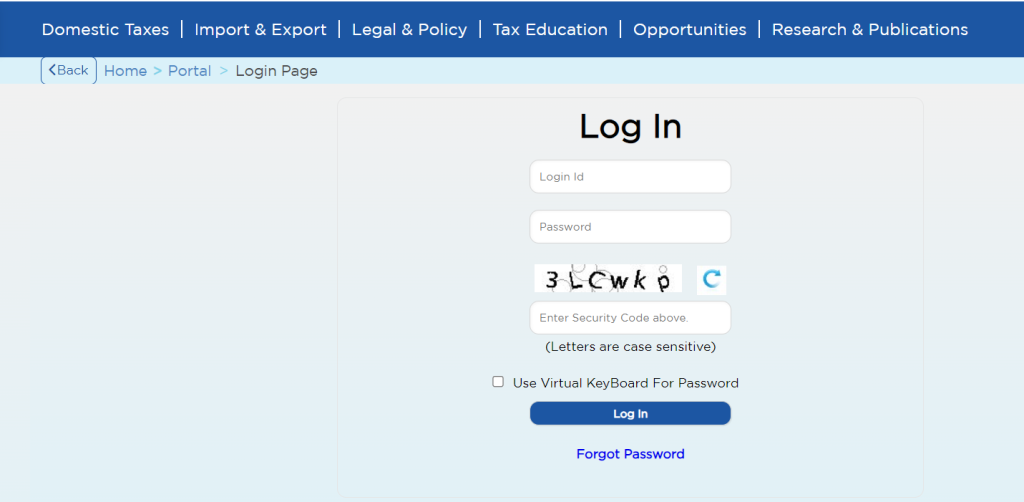

Step 3: Log in; Log in ID is the taxpayer TIN.

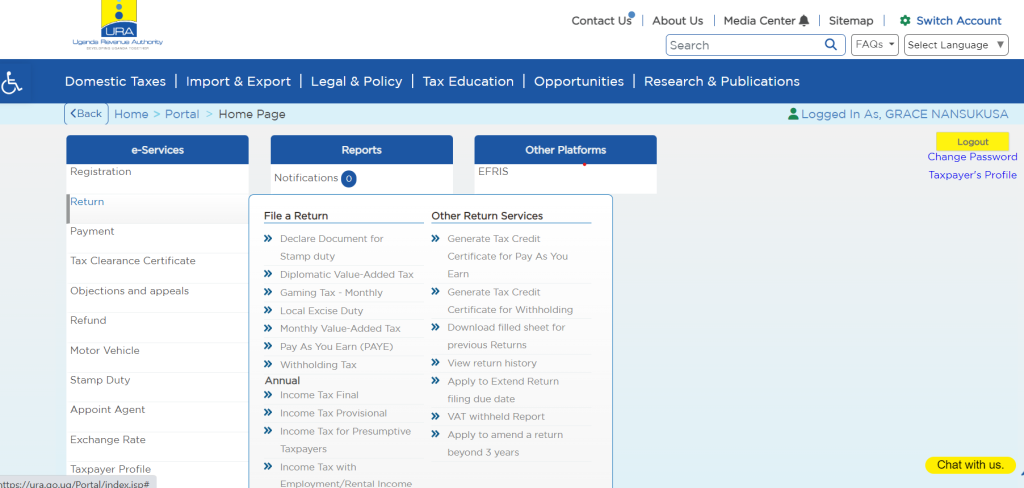

Step 4: Under e-services, select Return >>File a return and click on the applicable return type i.e. whether provisional or final income tax return.

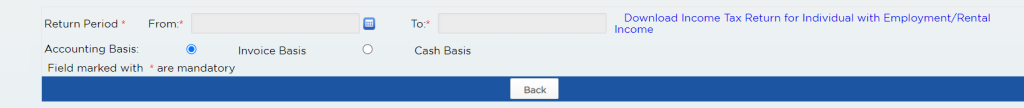

Step 5: Select the return period and download the return template/ form.

Step 6: Save the downloaded return template at a preferred location. It is a MS Excel template (Please do not rename it.)

Step 7: Open the downloaded return template and enable macros or content. (Please do not cut and paste any values in the sheet)

Step 8: Fill all required fields of the return template and make the necessary declarations. The tax payable will be computed and displayed.

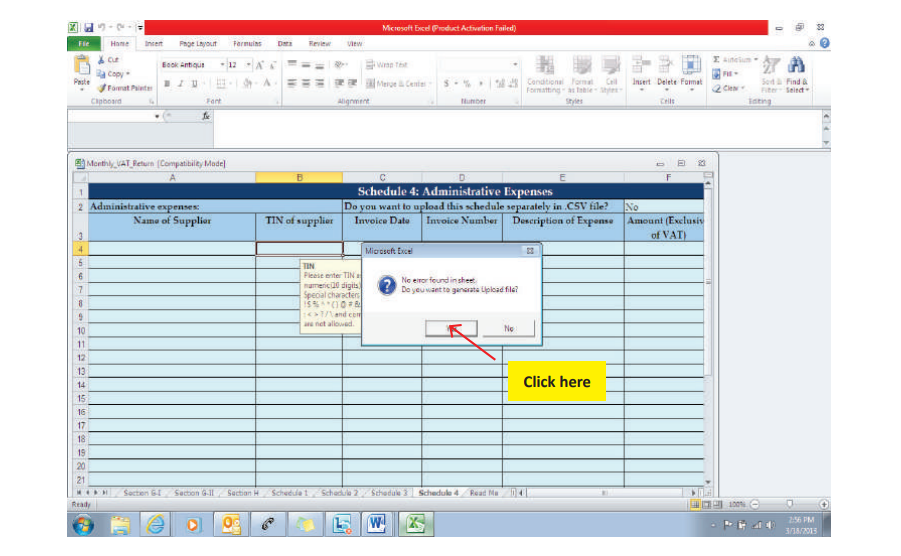

Step 9:After filling the required fields of the return template, Click validate

Step 10:If there is an error, you will be directed to the error page where you can correct the errors and validate again.

Step 12:If there is no error, click on yes to “save this template as an upload file”.

Save the upload file at a desired location.

Please note; At the point of saving the upload file, do not rename it.

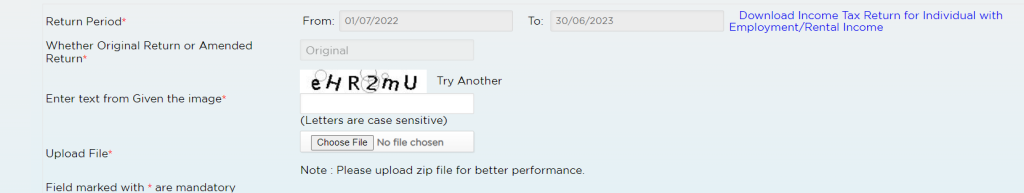

Step 13: Return to the same page on the URA portal where you downloaded the return template and upload the saved upload file.

Step 14: Click submit

Upon submission, an acknowledgement receipt will be displayed for printing and a copy of it will be sent to the taxpayer’s email address.

- You will suffer penalties for late filing which is Ugx. 200,000 or 2% of the tax liability for the period whichever is higher.

- You also give room for URA to estimate the tax liability for the period through an administrative assessment which at times becomes so inconvenient.