KAMPALA April 11th, 2022: Uganda Revenue Authority has registered one of its strongest performances this financial year, recording a solid surplus for the month of March and reducing its annual shortfall.

URA collected UGX 1,834.37 billion against a target of UGX 1,823.25 billion, with a surplus of UGX 11.11 billion and a performance rate of 100.61%.

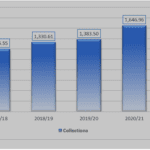

Trend analysis of March net revenue collections in the last five years

Domestic revenue collections were UGX 1,147.36 billion against a target of UGX 1,171.78 billion, registering a growth of 17.96% (UGX 174.70 billion) in comparison to March 2021. Major surpluses were registered in PAYE (UGX 38.62 billion) and Corporate tax (UGX 25.09 billion)

Customs collections were UGX 775.06 billion against a target of UGX 688.06 billion, posting a performance of 112.64% and a surplus of UGX 87.00 billion.

The Customs revenue collections also grew by UGX 70.27 billion (9.97 %) in March 2022 compared to March 2021.

Significant surpluses were registered in; VAT on imports by (UGX 49.57 billion), Petroleum duty by (UGX 23.23 billion), imports duty by (UGX 8.88 billion) and excise duty by (UGX 5.57 billion).

This was partly due to the re-opening of the economy, where some of the previously closed sectors and their associated value chains were able to contribute to the revenue basket.

URA continues to strengthen and implement her revenue enhancement mechanisms aimed at meeting this Financial year’s set revenue target of UGX 22.36 Trillion. These include;

- Tax register expansion– Our register has grown to 2,172,442 taxpayers, and we are targeting to have at least 5 million taxpayers on our register.

- Strengthening smart business solutions of Digital Tax Stamps and Electronic Fiscal Receipting and Invoicing Solution (EFRIS): URA has implemented approved structures to ensure sustainability and expanded on the traced and tracked products beyond the current eight products of; cigarettes, beers, sodas, water, wines, spirits, sugar, and cement. And in this period, we added; cooking oil, fruit and Vegetable juices, alcoholic & non-alcoholic beverages, plus fermented beverages. These solutions have grown the revenue contributions from the VAT and LED tax heads.

- Our automated processes make it attractive for the taxpayer to pay taxes. For example, one can file returns in the comfort of their home and apply for a TIN using their mobile phone.

- Mobile Tax office; We are also finding our taxpayers through our fully-fledged Mobile Tax office that helps us intensify tax education. So far, we have one bus and plan to acquire three more so that every region has access to tax services.

- Online Services: Most of our services are now accessible online, and any other queries can be responded to instantly on our WhatsApp line of 0772140000. WhatsApp also helps reach more persons, especially Small and Medium Enterprises, the young and Ugandans in the diaspora, and has a couple of other self-help services, making it easy for taxpayers to comply.

- ADR: We have rolled out some of the initiatives that we have taken the time to plan to make sure we cover the deficit.

Some of these include growing the Tax Register expansion; we adopted the use of Alternative Dispute Resolution (ADR) to amicably resolve tax disputes with taxpayers instead of wasting money in courts. - Technology in Customs: We have strengthened the use of available technology to enhance the taxpayers’ experience and revenue administration. We are stepping up the use of Satellite Technologies, Cargo Tracking Systems, and Non-Intrusive Inspection Technologies to facilitate trade.

- Client support: We have embarked on a cost-efficient service-centric approach of listening more to concerns and being more responsive to clients. We encourage taxpayers to embrace the voluntary disclosure avenue by doing a tax health check and cleaning their tax accounts without waiting for penalties.

- We, therefore, encourage the public to look out for more details on URA’s revenue performance for the period of July and March FY 2021/22.

No Comments yet!