By Solomon Kimbugwe

In the age of excessive use of internet and the ever-growing e-commerce market, the attraction to buy something offered through the digital process is trending. The preference to purchase items using the digital process coupled with the convenience of the item finding its way to you is what the scammers have taken advantage of to dupe online buyers.

Uganda Revenue Authority through its recently launched contact center has discovered this growing vice of Ugandans being cheated by these ‘briefcase’ online trading companies. These companies make empty promises to deliver items from abroad to willing purchasers only to receive them in vain.

Winfred Amuron, a Customs Officer attached to Entebbe Airport explained how these schemers make their “magic” work.

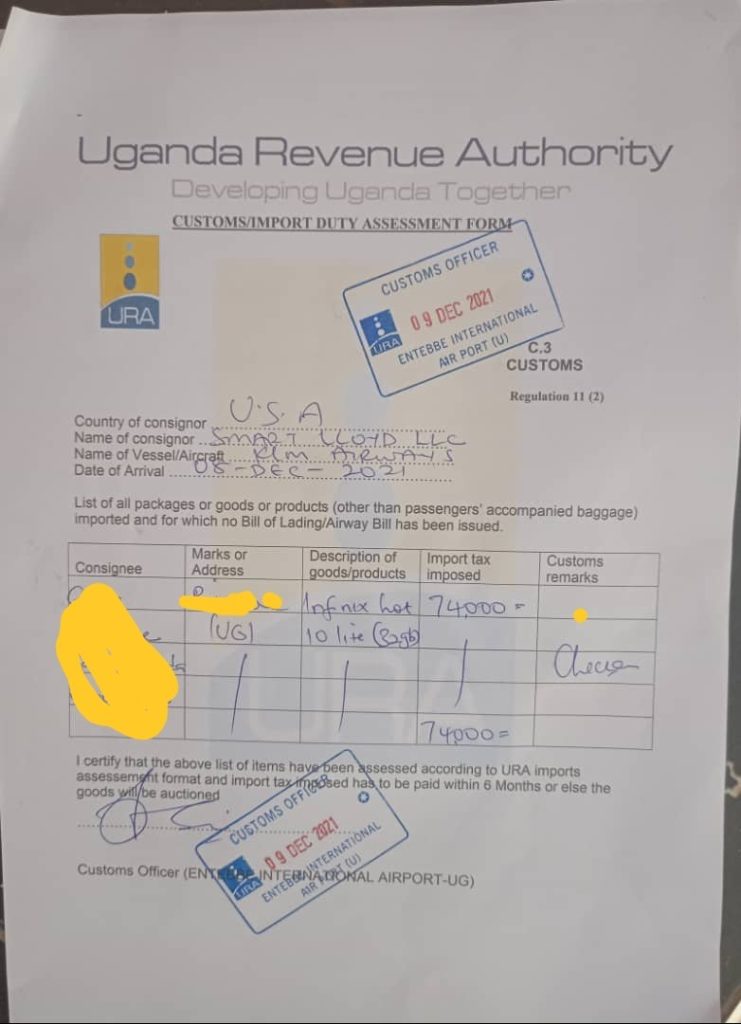

“These [schemers] for example LLYOD SMART Electronics (Facebook page name) post different commodities which they say they can import to willing buyers after a down payment of 50%. They then send the unsuspecting buyer a picture of the receipt in the name of the company”, Amuron narrated.

“About two days after, the schemers contact the buyer and inform him/her that the commodity has arrived in the country and that the buyer ought to send the company a prescribed amount to clear the taxes due with URA. The buyer is then sent a picture of a fake receipt purportedly from URA and this is the last time the buyer gets to hear from the schemers,” added Amuron.

With this detection, Abel Kagumire, the Commissioner Customs Department has advised online buyers to be cautious when transacting with any company that imports items from abroad.

An example of a fake import duty assessment used by fraudsters

In order to avoid recurring occurrences, Catherine Muyama, the Manager of Entebbe Customs cautions below on steps for handling express courier cargo.

- Upon receipt of a client’s parcel/package, the courier provides a tracking number for the package. The tracking number can be verified through the respective courier websites.

- If the package is dutiable, the courier must contact the client (buyer) through their customer care section advising them to appoint a customs agent.

- The Client (buyer) logs into their respective TIN accounts to appoint the customs Agent.

- An assessment of the taxes due on the imported item is communicated to the client online through his/her registered email with URA.

- The client proceeds to the Bank of choice/Bank Agent presents the assessment (PRN) and pays the taxes. NO money should be sent to any individual (Personal) account or Mobile money for taxes.

Muyama also revealed that currently, Uganda has 9 registered Courier Companies licensed by Customs to handle courier cargo clearance on behalf of importers. These include; DHL, Aramex, Freight in Time (U) Limited, Hesed Holdings Limited, Skynet Worldwide Express, Globex Express Couriers, FedEx/TNT, UPS/DAKS Couriers and EMS Courier/Posta Uganda.

The writer is the URA Digital Media Officer

NOW AM HERE BECAUSE OF YOU AND YOU AND YOUR TEAM THEY WON’T TO ALLOW TO MAKE ANY PAYMENT OF MY NATIONAL ID BUT I CANT PAY ANY THING AS PERSONAL TO GOVERNMENT OF UGANDA BE YOURE THE ONE THEFT MY ID BUT STILL DISTURBING ON THIS OF REPLACEMENT BUT I WANT AS YOU WHAT DO YOU MEANING ON THIS IDS TO SELLING TO EVERY ONE AND POOR PERNSON YOU WANT TO PAY HUUUUUUMMMM SEMA UPON THEM AND THESE POEPLE